Understanding Crypto Wallets: The Gateway to Digital Assets

As cryptocurrency continues to gain traction as a revolutionary form of money, the need for secure and user-friendly methods of storing and managing these digital assets has never been more critical. Enter the crypto wallet—the essential tool for any crypto enthusiast, investor, or trader. But what exactly is a trust wallet, and how does it work? Let’s explore this vital component of the cryptocurrency ecosystem.

What Is a Crypto Wallet?

A crypto wallet is a digital tool designed to store, manage, and interact with cryptocurrencies like Bitcoin, Ethereum, and many others. Unlike a traditional wallet, which holds physical cash, a crypto wallet does not store coins in the literal sense. Instead, it holds the private keys required to access and manage the ownership of cryptocurrency on the blockchain. These private keys are cryptographic codes that provide the holder with the ability to sign transactions, transferring ownership of the coins or tokens.

There are two main types of crypto wallets: hot wallets and cold wallets.

Hot Wallets vs. Cold Wallets

- Hot Wallets:

- These wallets are connected to the internet, allowing users to easily access and trade their cryptocurrencies.

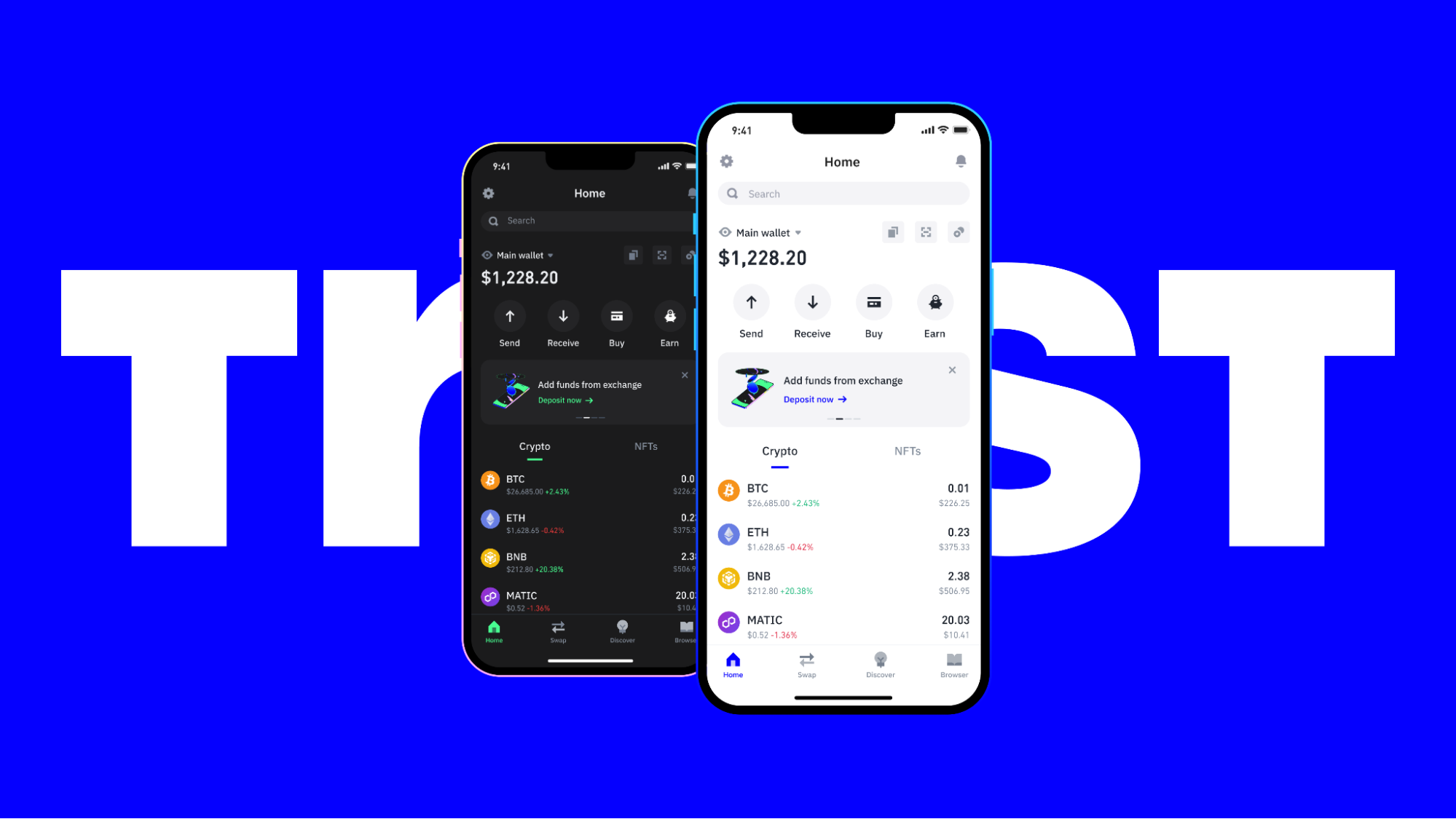

- They are generally more convenient for frequent transactions and are commonly used on platforms like mobile apps or desktop software.

- Popular examples include Coinbase Wallet, Metamask, and Exodus.

- The main downside to hot wallets is that they are more vulnerable to hacking due to their constant internet connection.

- Cold Wallets:

- Cold wallets are offline storage solutions that store private keys on hardware devices, such as USB sticks or hardware wallets.

- They offer a higher level of security since they are not connected to the internet, making them immune to online hacks.

- Common examples include Ledger Nano S and Trezor.

- However, cold wallets are less convenient for quick transactions and are typically used for long-term storage of cryptocurrencies.

Why Are Crypto Wallets Important?

Crypto wallets serve as a bridge between the user and the blockchain. Without a wallet, you cannot access or manage your digital assets. These wallets play a crucial role in:

- Security: Crypto wallets protect your private keys, ensuring that only you can access your digital assets. A loss of your private key means losing access to your cryptocurrency forever.

- Transaction Signing: Every time you send or receive cryptocurrency, the wallet signs the transaction using your private key to verify that you are the rightful owner of the assets.

- Access to Blockchain Networks: Crypto wallets are required to interact with various blockchain networks, enabling users to participate in activities such as buying, selling, or staking cryptocurrencies.

How to Choose the Right Crypto Wallet

Selecting the right crypto wallet depends on your needs and preferences. Here are a few factors to consider:

- Security: If you prioritize security, a cold wallet is your best bet. For those who trade frequently, a hot wallet may suffice, but always choose one with strong encryption and security features.

- Ease of Use: For beginners, hot wallets are usually easier to set up and use. Many come with user-friendly interfaces that make managing digital assets simple.

- Backup and Recovery Options: Ensure the wallet offers secure backup options, such as seed phrases (a series of words used to recover your wallet), in case your device is lost or stolen.

- Supported Cryptocurrencies: Not all wallets support every type of cryptocurrency. Make sure the wallet you choose supports the tokens you plan to use or invest in.

The Future of Crypto Wallets

The crypto wallet landscape is evolving rapidly, with new technologies and innovations improving usability, security, and compatibility. Features like biometric authentication, multi-signature wallets, and integration with decentralized finance (DeFi) platforms are pushing the boundaries of what wallets can do. As cryptocurrency adoption continues to grow, the role of crypto wallets in providing secure, seamless access to digital assets will become even more critical.